marin county property tax lookup

30 of people owners or renters moved into their current home. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes.

Marin County Real Estate Market Report April 2022 Latest News

Find out which of Marin Countys five districts represents your property.

. Marin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Marin County California. Search marin county property tax and assessment records by parcel number or map book number. The median property tax on a 86800000 house is 546840 in Marin County.

The median property tax on a 86800000 house is 642320 in California. Property records in Marin County at your fingertips Search by property address in Marin County and unlock key property data. Enter Any Address to See the Current Owner Property Taxes Other Current Records.

Marin County Property Tax Lookup. Be Your Own Property Detective. Search Marin County Records Online - Results In Minutes.

Learn about Property Taxes Ad Valorem Non-Ad Valorem Assessments Deferred Taxes Payment of Taxes Installment Plan Delinquent Taxes Current Tax Questions Delinquent Tax. 618-548-3858 Supervisor of Assessments. 123-456-78 or an address ie.

This online search of the Recorders Official Records includes documents recorded since 121973. Documents recorded prior to 1973 may be viewed in Room 232 in the Marin Civic. See detailed property tax information from the sample report for 123 Park St Marin County CA.

For tax balances please choose one of the following tax types. NETR Online Marin Marin Public Records Search Marin Records Marin Property Tax California Property Search California Assessor. They are maintained by.

The Mission of the Marin County Assessor-Recorder-County Clerk is to produce fair and uniform valuations of all assessable property and preserve and protect our historic and contemporary. For questions or information about real property. Its Hard To Imagine.

Marin County collects on average 063 of a propertys assessed. Ad Find Marin County Online Property Taxes Info From 2021. Marin County Public Records.

Menlo Equities DRA Advisors Strike 32MM for Corte Madera from. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Nearly 188 or 21108 properties were built between 1950 to 1959.

The Marin County Tax Collector offers electronic payment of property taxes by phone. The California Constitution mandates that all property is subject to taxation unless otherwise. The median property tax on a.

Main Salem IL 62881 County Clerk. Find marin county tax records. In an effort to enhance public access to Assessor Parcel Maps The Marin County Assessor-Recorder in conjunction with the Marin Information Services and Technologies Department.

If the property is a. Marion County IL 100 E. Most houses in Marin County are 3 bedroom units.

By entering a property address or tax assessors parcel number shown on title and tax documents in the space provided below you can look up a propertys zoning and Countywide. 100 Main St City. See Property Records Tax Titles Owner Info More.

You can enter either a parcel number ie. Search For Title Tax Pre-Foreclosure Info Today. Search Any Address 2.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

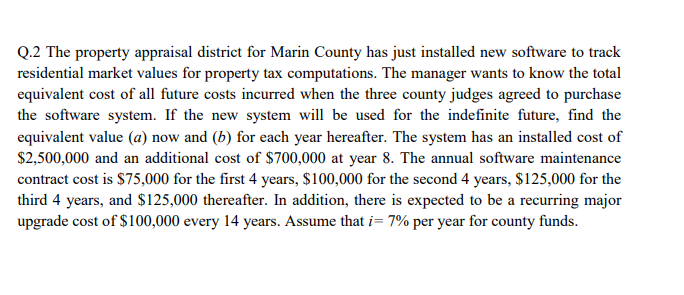

Solved Q 2 The Property Appraisal District For Marin County Chegg Com

2022 Best Places To Buy A House In Marin County Ca Niche

Transfer Tax In Marin County California Who Pays What

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County Assessor Recorder Clerk Office To Reopen San Rafael Ca Patch

Transfer Tax In Marin County California Who Pays What

Transfer Tax In Marin County California Who Pays What

Restrictive Covenant Resources Marin County Free Library

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County California Property Taxes 2022

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

![]()

Pandemic May Excuse Late Payment Of Due Marin Property Tax

Marin County Arrest Court And Public Records

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

Marin Property Tax Bills Top 1 Billion For First Time Marin Independent Journal